Cost of living

Inflation reached levels not seen since the 80s in 2022. While it has been gradually falling since, it remains above historical levels.

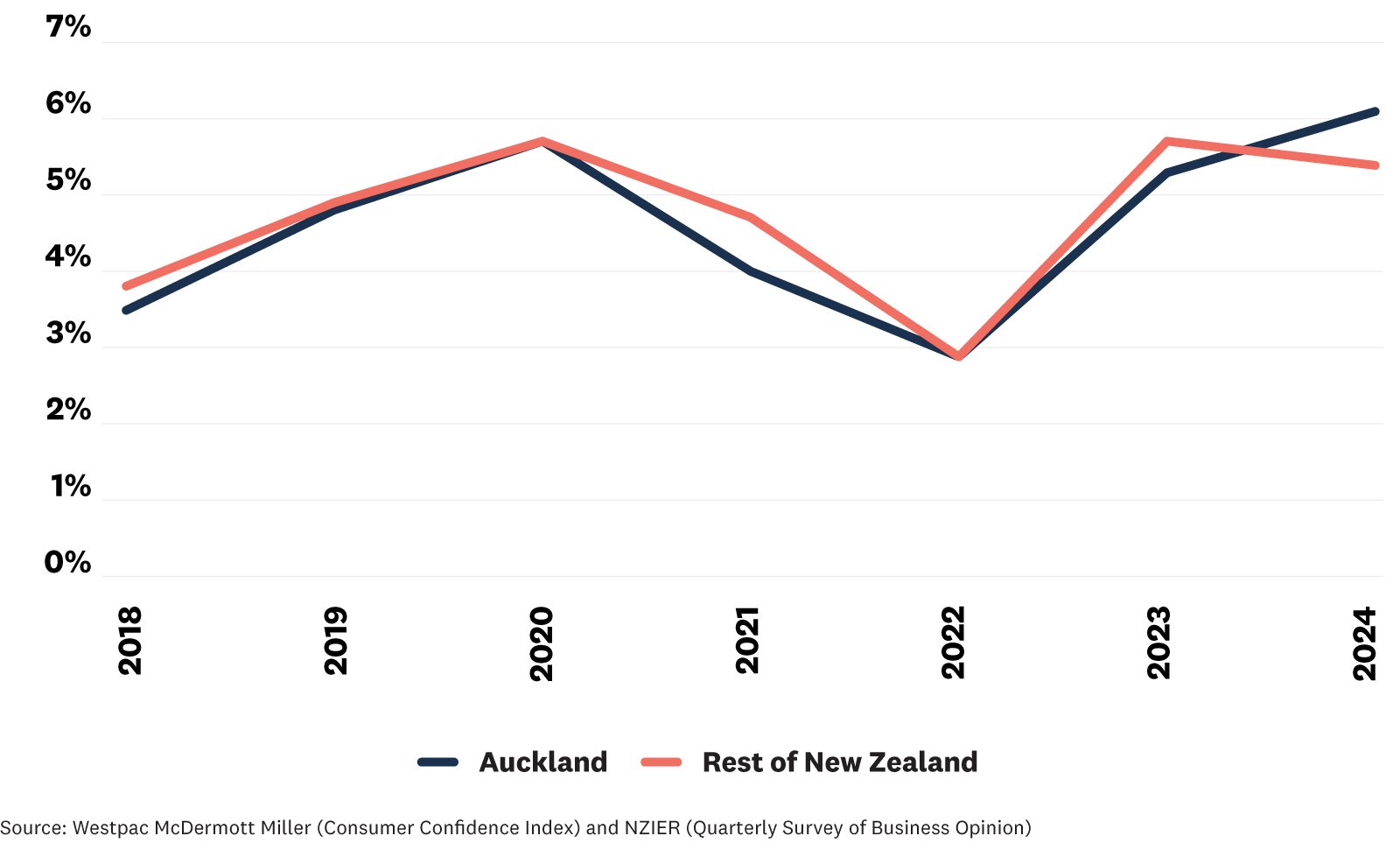

Consumer price index annual growth

Household income growth (March years)

Aucklanders, like many people around the world, are currently living through a sustained and sharp increase in the cost of living, with the costs of many everyday items increasing in price.

Consumer price inflation reached its highest rate in 36 years in 2022, and while it has come back from that, it remains well above historical levels. As a result, consumers are having to spend more to purchase the same goods and services. Housing costs have also increased, through high interest rates (which have been raised in an attempt to dampen general inflation), higher rent levels (which have increased at their highest rate this century), and higher costs for construction, rates and utilities.

This inflationary situation is primarily attributed to the long-term impacts of monetary policies implemented during COVID to stimulate the economy, as well as international supply chain constraints. Spikes in inflation after economic shocks are not uncommon in Auckland, however the magnitude and longevity of this high-inflation period is rare.

-

Businesses have also been experiencing higher prices. The Producer Price Index (PPI), which measures inflation at the wholesale level, peaked at 8.7% in March 2022 – well above the December 2019 level of 2.0%. Higher business input costs also drive increases in consumer inflation, as businesses pass costs onto consumers.

At the same time, most businesses are expecting some easing in costs (and subsequently the prices they pass on to consumers) over the next three months according to the latest ANZ business outlook.

While living costs have surged for Aucklanders in recent years, there is some encouragement. Earnings and average household incomes have largely kept pace with inflation since 2019. This was not the case during the GFC in 2008-09. In the year to March 2024, Aucklanders’ average household income grew at a faster rate (6.1%) than inflation (4.0%).

These rising incomes help offset the impact on some Aucklanders of increasing prices. For example, despite the aforementioned increase in rental costs, rent has actually decreased, as a proportion of the average household income, since 2019. This is not the case for homeowners, however, with mortgage payments increasing as a proportion of income.

International comparisons suggest that Auckland is a relatively expensive city to live in. While incomes have increased to (at least partly) offset higher costs of living, Auckland’s overall income levels are lower than many comparable international cities. That is, while affordability may not have gotten significantly worse in recent years, it is starting from a relatively unaffordable base. The Mercer Cost of Living Survey ranks Auckland as the 111th most expensive city in the world, with Wellington slightly lower at 139th.

Sources: Liveability ranking – Economist Intelligence Unit: Global liveability index. Cost of living ranking – Mercer: Cost of Living Survey. Infometrics: Regional Economic Profile. Interest rates (OCR) – RBNZ: The official cash rate (OCR) and past monetary policy decisions. Consumers price index (CPI) – StatsNZ: CPI. Producers price index (PPI) input prices – StatsNZ: PPI

Auckland Economic Monitor

A summary of key economic information about the region

Auckland’s economy: What’s changed?

Deep dives

Cost of living

Inflation reached levels not seen since the 80s in 2022 and remains above historical levels.

Investment & trade

Auckland plays a significant role in the country’s investment and trade landscape.

Auckland’s industrial employment areas

Trends over the last two decades.