Economic confidence

Consumer confidence

Auckland confidence indices

Tāmaki Makaurau Auckland's consumer confidence has fluctuated over the last 12 months, as part of a complex – yet promising – trend in sentiment.

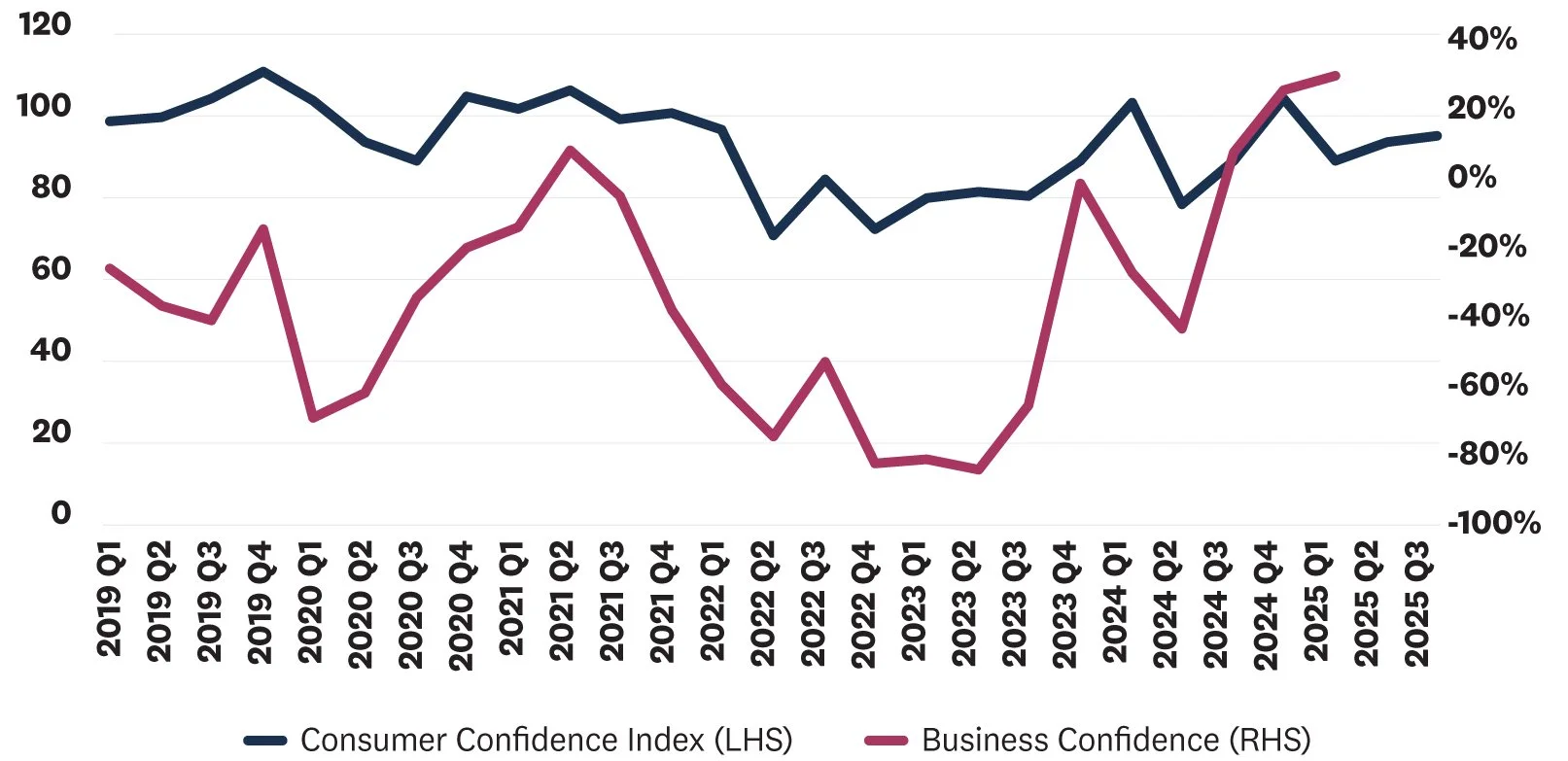

Both consumer and business confidence are strong indicators of the sense of stability and security within an economy. Consumer confidence in Auckland fell during the first half of 2024, but increased to levels similar to those prior to the COVID-19 period in the December 2024 quarter.

Auckland consumers were slowly beginning to feel more optimistic, in part reflecting less pressure on living costs and lower interest rates. Inflation-adjusted retail sales were, however, still down 4.3 per cent in 2024.

While consumer confidence was cautiously trending upward in late 2024, suggesting potential for gradual improvement in 2025, a slight fall in confidence in the March 2025 quarter shows that the economic environment is still challenging. Concerns around macroeconomic conditions globally, as well as higher unemployment and the after-effects of higher price levels domestically, are having a dampening effect on spending.

-

Consumer confidence in Auckland was relatively resilient during the COVID-19 period, but hit record lows in 2022.

Auckland’s (and the rest of New Zealand’s) consumer confidence slowly improved during 2023 and early 2024.

Consumer confidence has fluctuated quarter-byquarter since then. It fell considerably in Q2 2024, reflecting household cost of living pressures and a more pessimistic economic outlook, but increased again in the second half of 2024, reaching pre-pandemic levels – this more optimistic outlook, driven by declining interest rates, has been challenged again in early 2025, with higher unemployment and volatility on global markets.

-

Consumer spending in Auckland was $25.8bn in the year to March 2025. This was 2.2% lower than in 2024.

The 2025 result reflects the slight decline in confidence in the March 2025 quarter.

Spending in the rest of New Zealand also fell but by somewhat less (-0.9%).

Inflation-adjusted retail sales continued to decline in 2024 in Auckland (-4.3%) and in the rest of New Zealand (-3.1%).

Sources: Confidence indices – Westpac McDermott Miller (Consumer Confidence Index) and NZIER (Quarterly Survey of Business Opinion). Consumer spending – Infometrics: Quarterly economic monitor

Business confidence

Business confidence has increased considerably over the last 12 months, reaching its highest level in a decade.

In 2022 and 2023, Auckland business confidence fell to levels not seen since the GFC. Despite a brief post-election boost, confidence waned again during early 2024.

But since the middle of 2024, Auckland business confidence has increased significantly. It is now at a level not seen since 2014- 2015. While demand in the economy is still on the weaker side, the latest data (Q1 2025) points to businesses expecting some improvement in the coming months, driven by lower interest rates, among other factors.

However, recent political and economic volatility globally has reduced business confidence in some of our main trading partners. In turn, this has likely created some pessimism among Auckland’s export-focussed businesses. While this is not yet reflected in the data, some downturn may be expected in business confidence in subsequent quarters.

-

Business confidence in the March 2025 quarter was +31%, meaning that a net 31% of firms expect improving economic conditions in the short-term.

This is significantly higher than the March 2024 quarter (-25%). In fact, it is the highest figure since September 2014.

Business confidence has continued to fluctuate considerably in the recent past, reflecting changes in underlying economic conditions. It has been negative for most of the last 7 years, reaching historic lows through 2022 and 2023.

The positive trend in business confidence through the second half of 2024 and early 2025 suggested a potential recovery phase for businesses in Auckland. These results should be interpreted with caution, however, given current global economic volatility.

Sources: Westpac McDermott Miller (Consumer Confidence Index) and NZIER (Quarterly Survey of Business Opinion)